CPA

Intermediate Leval

Economics August 2021 Suggested Solutions

Revision Kit

| ➦ | Economics-September-2015-Pilot-Paper |

| ➦ | Economics-November-2015-Past-Paper |

| ➦ | Economics-May-2016-Past-paper |

| ➦ | Economics-November-2016-Past-Paper |

| ➦ | Economics-November-2017-Past-paper |

| ➦ | Economics-May-2017-Past-paper |

| ➦ | Economics-November-2018-Past-paper |

| ➦ | Economics-May-2018-Past-paper |

| ➦ | Economics-May-2019-Past-paper |

| ➦ | Economics-November-2019-Past-paper |

| ➦ | Economics-November-2020-Past-paper |

| ➦ | Economics-December-2021-Past-paper |

| ➦ | Economics-May-2021-Past-paper |

| ➦ | Economics-August-2021-Past-paper |

QUESTION 1a

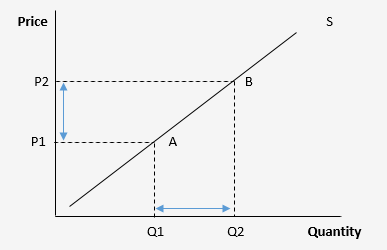

When there is a change in the quantity supplied due to a change in price while other factors remain constant, it results in a movement along the supply curve.

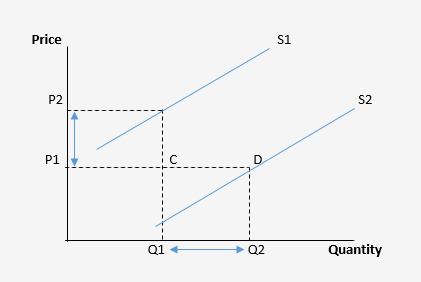

A shift in a supply curve occurs when there is a change in factors other than price that influence the overall supply in the market. This could include changes in technology, input costs, or government regulations.

In the first diagram, the movement along the supply curve (S) showcases how an increase in price leads to an increase in quantity supplied (from point A to point B).

In the second diagram, the shift in the supply curve (S1 to S2) demonstrates a change in overall supply due to external factors. Here, at the same price level, the quantity supplied is different (from point C to point D).

Recognizing these distinctions is essential for understanding the dynamics of supply in response to various economic factors.

QUESTION 1b

(ii) Real Wages:

Real wages represent the purchasing power of wages and are adjusted for inflation. It reflects the actual value of wages in terms of goods and services that can be bought.

(iii) Labour Productivity:

Labour productivity measures the amount of output produced per unit of labor input. It is a crucial indicator of economic efficiency and growth, reflecting how efficiently labor is utilized in the production process.

(iv) Derived Demand:

Derived demand for labor occurs when the demand for a particular good or service leads to a demand for the labor required to produce that good or service. It is derived from the demand for the final product.

QUESTION 2(a)

In the context of labor, the Marginal Factor Cost of hiring an additional worker is the extra cost associated with employing that worker. It considers the change in total labor cost resulting from the hiring of one more worker.

Mathematically, MFC can be calculated as the change in total cost divided by the change in the quantity of the factor employed:

MFC = Δ TC / Δ Q

Where:

Δ TC is the change in total cost,

Δ Q is the change in the quantity of the factor employed.

Marginal Factor Cost is essential for firms in making decisions about how much of a factor of production to employ, helping them determine the optimal level of input usage to maximize profits.

QUESTION 2b

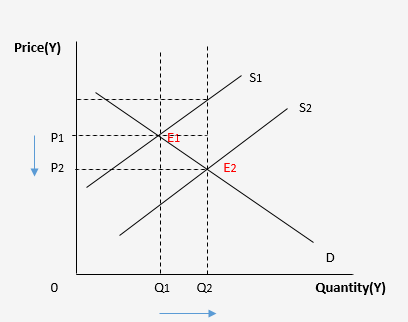

Initially, commodity Y is at its equilibrium point where the demand (D) and supply (S) curves intersect. This point is represented by E1 with the equilibrium price P1 and quantity Q1.

With the introduction of the subsidy, the effective price received by producers increases, leading to an expansion of the quantity supplied. As a result, the new equilibrium point is E2 with a higher quantity Q2 and a lower price P2.

The subsidy encourages consumers to purchase more of commodity Y, effectively lowering the cost of production for producers. This shift in equilibrium quantity and price illustrates the positive impact of the government subsidy on the consumption of commodity Y.

QUESTION 2c

QUESTION 2(d)

Due to the fixed number of equipment in the short run, transfer earnings are negligible, making quasi rent equivalent to the total earnings from the equipment. However, in the long run, the supply of equipment becomes perfectly elastic, allowing any quantity to be supplied at OP. Consequently, the supply expands to OM, causing prices to drop to E"M. The quasi rent may diminish as the price aligns with transfer earnings (OP).

QUESTION 2(e)

Example:

Let's consider the example of unemployment benefits, which are a common form of transfer payments. When an individual loses their job and qualifies for unemployment benefits, the government provides financial assistance to help cover living expenses during the period of unemployment.

In this case:

Transfer payments play a crucial role in social policy and can include various forms such as social security, welfare, subsidies, and grants. They are an essential tool for governments to address income inequality and provide support to vulnerable populations.

QUESTION 3a

2. Inadequate Infrastructure:

Poor infrastructure, including inadequate transportation, irrigation, and storage facilities, can lead to post-harvest losses and increased production costs. Limited access to markets can also constrain the ability of farmers to sell their products at competitive prices.

3. Land Tenure Issues:

Insecure land tenure and unclear property rights may discourage long-term investments in land improvement and modern farming practices. Farmers may be hesitant to make improvements if they fear losing access to their land.

4. Price Volatility:

Fluctuations in commodity prices can significantly impact the income of farmers. Price volatility may result from factors such as global market conditions, weather events, and changes in demand, making it difficult for farmers to plan and invest effectively.

5. Limited Technology Adoption:

The slow adoption of modern agricultural technologies and practices can impede productivity growth. Insufficient training and extension services may contribute to a lack of awareness and understanding of new farming methods.

6. Dependence on Rainfed Agriculture:

Reliance on rainfed agriculture leaves farmers vulnerable to the variability of weather patterns. Droughts or excessive rainfall can lead to crop failures, affecting yields and farmer incomes.

7. Trade Barriers:

Trade barriers and unfavorable trade policies may limit the ability of farmers to access international markets. This can hinder the growth of the agricultural sector by reducing opportunities for exports and competition.

Addressing these economic factors is crucial for promoting sustainable development and improving the performance of the agricultural sector in developing countries.

QUESTION 3b

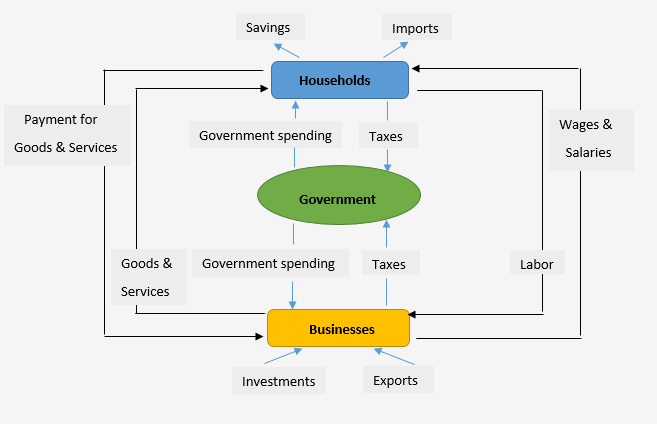

At the core of this cycle are households, which play a central role by providing labor to businesses. In return, households receive wages and salaries for their contributions.

Businesses utilize the labor from households to produce a myriad of goods and services. As households spend on these products, businesses generate income, fostering a continuous loop.

The government, represented in the cycle, plays a dual role. Through taxation, it collects funds from households and businesses. Simultaneously, the government engages in spending to provide public goods and services, influencing economic activity.

Externally, the external sector involves the exchange of exports and imports. Businesses sell goods and services abroad, contributing to income, while imports satisfy domestic demands.

Essential to this economic dance is the continuous flow of payments for goods and services. As businesses receive income, they in turn pay wages and salaries to households, closing the loop and sustaining the circular flow of income.

This dynamic cycle encapsulates the intricate relationships among households, businesses, government, and the external sector, providing a comprehensive view of the closed economy's economic activity.

QUESTION 3c

2. Lack of Legal Autonomy:

The absence of clear legal provisions establishing the independence of the central bank can undermine its autonomy. Legal frameworks that do not adequately shield the central bank from political pressures may hinder its effectiveness in implementing sound monetary policies.

3. Fiscal Policy Interference:

Interference with fiscal policy decisions can also impact the central bank's independence. In some cases, governments may pressure central banks to finance budget deficits or engage in activities that are beyond the scope of traditional monetary policy, compromising the central bank's independence.

4. Lack of Accountability:

Insufficient transparency and accountability mechanisms can contribute to the erosion of central bank independence. A lack of clear communication about policy decisions and objectives may undermine public trust and lead to increased political interference.

5. Economic and Financial Crises:

During times of economic or financial crises, there may be increased pressure on central banks to deviate from established policies. The urgency to address immediate challenges may lead to compromises on central bank independence in favor of short-term crisis management strategies.

6. Public Opinion and Populism:

Public sentiment and political populism can impact central bank independence. If public opinion influences policymakers to pursue unconventional or populist measures, central banks may face pressure to align with popular sentiment rather than adhere to established economic principles.

7. International Influences:

External factors, such as international economic pressures or financial dependencies, may also limit central bank independence. Dependencies on external funding or adherence to international agreements may constrain the central bank's autonomy in decision-making.

Central bank independence is crucial for maintaining price stability, controlling inflation, and promoting long-term economic growth. Efforts to enhance independence often involve establishing clear legal frameworks, ensuring transparency, and promoting accountability.

QUESTION 4a

2. Pricing and Allocative Efficiency:

Consumer surplus is used to assess the efficiency of pricing and resource allocation in a market. When markets are in equilibrium, and prices are set where supply equals demand, consumer surplus is maximized. This helps in achieving allocative efficiency, ensuring that resources are allocated to their most valued uses.

3. Policy Evaluation:

Policymakers and economists use consumer surplus to evaluate the impact of various economic policies. For example, changes in taxes, subsidies, or regulations can affect consumer surplus. Analyzing these changes helps policymakers understand how different policies impact the well-being of consumers.

4. Comparative Analysis:

Consumer surplus allows for comparisons between different market structures and situations. It can be used to compare consumer welfare in competitive markets versus monopolistic markets, or before and after the implementation of a new policy or technology.

5. Market Efficiency:

High levels of consumer surplus in a market are often associated with high levels of consumer satisfaction and efficient resource allocation. Economists and policymakers use consumer surplus as an indicator of market efficiency and to identify areas where improvements can be made.

6. Consumer Behavior Studies:

Consumer surplus is utilized in economic research and studies on consumer behavior. It helps economists and researchers understand how consumers value goods and services, make choices, and respond to changes in market conditions.

7. Bargaining Power and Negotiation:

In situations where consumers have bargaining power, such as in negotiations or during sales and discounts, understanding consumer surplus can be beneficial. Consumers can use their knowledge of surplus to make more informed decisions and negotiate better deals.

Consumer surplus is a valuable concept in economics, providing insights into market dynamics, consumer satisfaction, and the efficiency of resource allocation. It plays a crucial role in economic analysis and policy formulation.

QUESTION 4b

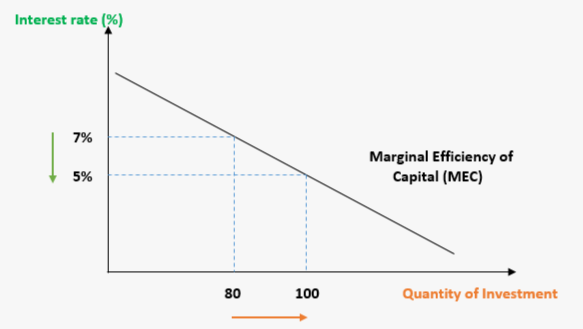

In the provided diagram, we observe a cut in the interest rate from 7% to 5%, resulting in an increase in investment from 80 to 100 units. This illustrates how changes in the interest rate influence the Marginal Efficiency of Capital.

The Marginal Efficiency of Capital is influenced by various factors, including:

This diagram and the associated factors provide a comprehensive understanding of how the Marginal Efficiency of Capital is determined and how it responds to changes in various economic parameters.

QUESTION 4(c)

2. Decrease in Output:

The economy experiences a decrease in output and production levels as businesses cut back on manufacturing and services. This reduction in output contributes to a negative output gap, where actual output falls below the economy's potential output.

3. Falling Prices:

Deflationary gaps are associated with falling prices or deflation. As demand decreases, businesses may lower prices to attract consumers, leading to a general decline in the price level. While falling prices may seem beneficial to consumers initially, persistent deflation can have negative effects on economic growth and debt dynamics.

4. Lower Income and Profits:

Reduced economic activity and falling demand result in lower incomes for households and lower profits for businesses. This can create a negative feedback loop, as lower incomes lead to further declines in consumer spending, exacerbating the deflationary gap.

5. Increased Debt Burden:

In a deflationary environment, the real value of debt increases because the debt remains fixed while prices fall. This can create financial challenges for households and businesses with outstanding debt, potentially leading to debt defaults and financial instability.

6. Limited Monetary Policy Effectiveness:

Central banks may find it challenging to use conventional monetary policy tools, such as interest rate reductions, to stimulate the economy in a deflationary gap. When interest rates are already low, the effectiveness of further rate cuts may be limited, necessitating unconventional policy measures.

7. Long-Term Economic Consequences:

Persistent deflationary gaps can have long-term consequences for an economy, including a slowdown in investment, innovation, and productivity growth. This can create a cycle of economic stagnation that is difficult to overcome.

It is crucial for policymakers to address deflationary gaps through appropriate fiscal and monetary measures to stimulate demand, encourage investment, and mitigate the negative effects on employment and economic growth.

QUESTION 4(d)

QUESTION 5a

2. Trade Balance Adjustment:

A free exchange rate system facilitates adjustments in the trade balance. If a country experiences a trade deficit, its currency may depreciate, making its exports more competitive and imports more expensive. This can help rebalance trade and reduce external imbalances.

3. Monetary Policy Independence:

Countries with a free exchange rate system have more flexibility in conducting independent monetary policies. Central banks can adjust interest rates to address domestic economic conditions without being constrained by the need to maintain a fixed exchange rate.

4. Price Stability:

A free exchange rate system can contribute to price stability by allowing the exchange rate to act as a shock absorber. When a country faces inflationary pressures, its currency may appreciate, helping to offset inflation by making imports more affordable.

5. Market Efficiency:

Market-driven exchange rates promote efficiency in the allocation of resources. Prices and exchange rates adjust based on market information and participants' expectations, leading to a more efficient allocation of capital, labor, and goods.

6. Investment Attractiveness:

A free exchange rate system can make a country more attractive to foreign investors. Investors may be more willing to invest in a country where exchange rates are determined by market forces, as it reduces the risk of sudden and unpredictable government interventions.

7. Market Discipline:

A free exchange rate system imposes market discipline on policymakers. If economic policies are unsustainable, market forces can lead to currency depreciation, sending signals to policymakers to make necessary adjustments to maintain economic stability.

Embracing a free exchange rate system offers several advantages, promoting economic flexibility, stability, and efficient resource allocation. However, it also requires effective monetary and fiscal policies to manage potential risks and uncertainties.

QUESTION 5b

2. Increased Choice:

Price wars often lead to product differentiation and increased variety as firms seek ways to stand out from competitors. Consumers benefit from a broader range of choices, allowing them to select products or services that best meet their preferences and needs.

3. Improved Quality:

Firms may focus on enhancing the quality of their products or services to gain a competitive edge during a price war. Consumers can benefit from improved product features, innovation, and overall better quality as companies strive to attract and retain customers.

4. Innovation and Upgrades:

In a competitive market environment, firms may invest in research and development to innovate and upgrade their offerings. Consumers can experience the introduction of new technologies, features, or improvements in existing products as companies vie for market share.

5. Consumer Empowerment:

Price wars empower consumers by giving them more influence and control. Firms are compelled to listen to consumer preferences and respond to market demands to remain competitive. This can lead to a customer-centric approach, where businesses prioritize customer satisfaction and loyalty.

6. Economic Efficiency:

Price wars contribute to economic efficiency as firms seek to streamline operations, reduce costs, and become more efficient in order to sustain lower prices. This efficiency can lead to overall improvements in the economy and increased productivity.

7. Bargaining Power:

Consumers gain bargaining power during a price war as firms compete for their business. This can lead to more favorable terms, discounts, and promotions for consumers, enhancing their ability to secure better deals in the marketplace.

While price wars can be intense and challenging for businesses, the resulting benefits for consumers include lower prices, increased choice, improved quality, innovation, and greater consumer empowerment.

QUESTION 5(c)

QUESTION 5(d)

2. Exchange Rate Stability:

The IMF plays a role in promoting exchange rate stability and facilitating the orderly adjustment of exchange rates. It provides a forum for member countries to discuss and coordinate exchange rate policies, aiming to prevent competitive devaluations and maintain global economic stability.

3. Policy Advice and Surveillance:

The IMF offers policy advice and conducts economic surveillance to assess the economic and financial policies of its member countries. It provides recommendations to promote macroeconomic stability, sustainable growth, and the effective functioning of the international monetary system.

4. Capacity Development:

The IMF provides technical assistance and capacity development to help member countries strengthen their institutional and policy frameworks. This includes training and support in areas such as fiscal policy, monetary policy, financial regulation, and governance.

5. Crisis Prevention and Resolution:

The IMF works to prevent and resolve financial crises by promoting sound economic policies and providing financial support when necessary. In times of crisis, the IMF collaborates with countries to design and implement effective policy measures to restore stability and confidence.

6. Global Economic Research:

The IMF conducts extensive economic research and analysis to enhance its understanding of global economic trends and challenges. It publishes reports, forecasts, and analyses that contribute to the international community's knowledge of economic developments and policy options.

7. Special Drawing Rights (SDRs):

The IMF administers the international reserve asset known as Special Drawing Rights (SDRs). SDRs are allocated to member countries in proportion to their IMF quotas, providing liquidity and supplementing the existing reserves of countries.

8. Coordination with Other International Organizations:

The IMF collaborates with other international organizations, such as the World Bank and the World Trade Organization, to address global economic challenges comprehensively. This coordination aims to foster economic stability, development, and international trade.

The IMF plays a central role in promoting international monetary cooperation, stability, and sustainable economic growth. Its activities span financial assistance, policy advice, research, and capacity development to support the stability and well-being of the global economy.

QUESTION 6a

Price discrimination is a strategic pricing practice used by businesses to capture consumer surplus and optimize revenue by tailoring prices to different market segments or individual consumers.

QUESTION 6b

2. Unemployment:

The pandemic has caused a surge in unemployment as businesses faced closures or reduced operations. Many industries, particularly those in travel, hospitality, and entertainment, experienced significant job losses, impacting livelihoods globally.

3. Supply Chain Disruptions:

The disruption of global supply chains has been a major effect of the pandemic. Restrictions on movement and factory closures in various countries have disrupted the production and distribution of goods, leading to shortages and delays.

4. Decline in International Trade:

International trade has been adversely affected by the pandemic. Reduced demand, logistical challenges, and trade barriers have led to a decline in the volume of global trade, impacting economies that heavily rely on exports.

5. Government Debt and Fiscal Stimulus:

Governments worldwide implemented fiscal stimulus measures to mitigate the economic impact of the pandemic. However, this has led to increased government debt levels as countries borrowed to fund relief packages, healthcare systems, and economic recovery efforts.

6. Digital Transformation:

The pandemic accelerated digital transformation trends. Businesses and industries adopted remote work, e-commerce, and digital communication tools, leading to shifts in business models and increased reliance on technology.

7. Inequality:

The pandemic exacerbated existing inequalities within and between countries. Vulnerable populations, informal workers, and those in low-income sectors faced disproportionate economic challenges, widening social and economic disparities.

8. Changes in Consumer Behavior:

Consumer behavior underwent significant changes as a response to the pandemic. Shifts in spending patterns, increased reliance on online services, and a focus on essential goods and services influenced market dynamics.

9. Impact on Travel and Tourism:

The travel and tourism industry was severely impacted by the pandemic. Travel restrictions, lockdowns, and health concerns led to a decline in international and domestic tourism, affecting airlines, hotels, and related businesses.

10. Resilience and Adaptation:

The pandemic highlighted the importance of resilience and adaptability in the face of global challenges. Businesses and economies that were able to adapt quickly to changing circumstances demonstrated greater resilience during the crisis.

The effects of the Covid-19 pandemic on the world economy underscore the interconnectedness of nations and the need for coordinated global responses to address challenges and promote recovery.

QUESTION 6(c)

(ii) Economic Advantages:

In summary, a free enterprise economic system promotes efficiency, innovation, individual freedom, and economic growth through competitive markets and the pursuit of self-interest.

QUESTION 7(a)

While credit creation is a fundamental function of commercial banks, various factors, including regulatory constraints, economic conditions, and risk considerations, can limit the extent to which credit creation can contribute to the expansion of the money supply.

QUESTION 7b

| ➧ | Financial Accounting -September-2015-Pilot-Paper |

| ➧ | Financial Accounting -November-2015-Past-Paper |

| ➧ | Financial Accounting -May-2016-Past-paper |

| ➧ | Financial Accounting-November-2016-Past-Paper |

| ➧ | Financial Accounting-November-2017-Past-paper |

| ➧ | Financial Accounting-May-2017-Past-paper |

| ➧ | Financial Accounting-November-2018-Past-paper |

| ➧ | Financial Accounting-May-2018-Past-paper |

| ➧ | Financial Accounting-May-2019-Past-paper |

| ➧ | Financial Accounting-November-2019-Past-paper |

| ➧ | Financial Accounting-November-2020-Past-paper |

| ➧ | Financial Accounting-December-2021-Past-paper |

| ➧ | Financial Accounting-April-2021-Past-paper |

| ➧ | Financial Accounting-August-2021-Past-paper |

| ➧ | Quantitative Analysis -September-2015-Pilot-Paper |

| ➧ | Quantitative Analysis-November-2015-Past-Paper |

| ➧ | Quantitative Analysis-May-2016-Past-paper |

| ➧ | Quantitative Analysis-November-2016-Past-Paper |

| ➧ | Quantitative Analysis-December-2017-Past-paper |

| ➧ | Quantitative Analysis-May-2017-Past-paper |

| ➧ | Quantitative Analysis-November-2018-Past-paper |

| ➧ | Quantitative Analysis-May-2018-Past-paper |

| ➧ | Quantitative Analysis-May-2019-Past-paper |

| ➧ | Quantitative Analysis-November-2019-Past-paper |

| ➧ | Quantitative Analysis-November-2020-Past-paper |

| ➧ | Quantitative Analysis-December-2021-Past-paper |

| ➧ | Quantitative Analysis-April-2021-Past-paper |

| ➧ | Quantitative Analysis-August-2021-Past-paper |

| ➧ | Introduction to Law and Governance-September-2015-Pilot-Paper |

| ➧ | Introduction to Law and Governance-November-2015-Past-Paper |

| ➧ | Introduction to Law and Governance-May-2016-Past-paper |

| ➧ | Introduction to Law and Governance-November-2016-Past-Paper |

| ➧ | Introduction to Law and Governance-May-2017-Past-paper |

| ➧ | Introduction to Law and Governance-November-2017-Past-Paper |

| ➧ | Introduction to Law and Governance-November-2018-Past-paper |

| ➧ | Introduction to Law and Governance-May-2018-Past-paper |

| ➧ | Introduction to Law and Governance-May-2019-Past-paper |

| ➧ | Introduction to Law and Governance-November-2019-Past-paper |

| ➧ | Introduction to Law and Governance-November-2020-Past-paper |

| ➧ | Introduction to Law and Governance-December-2021-Past-paper |

| ➧ | Introduction to Law and Governance-April-2021-Past-paper |

| ➧ | Introduction to Law and Governance-August-2021-Past-paper |

| ➧ | Financial Accounting -September-2015-Pilot-Paper |

| ➧ | Financial Accounting -November-2015-Past-Paper |

| ➧ | Financial Accounting -May-2016-Past-paper |

| ➧ | Financial Accounting-November-2016-Past-Paper |

| ➧ | Financial Accounting-November-2017-Past-paper |

| ➧ | Financial Accounting-May-2017-Past-paper |

| ➧ | Financial Accounting-November-2018-Past-paper |

| ➧ | Financial Accounting-May-2018-Past-paper |

| ➧ | Financial Accounting-May-2019-Past-paper |

| ➧ | Financial Accounting-November-2019-Past-paper |

| ➧ | Financial Accounting-November-2020-Past-paper |

| ➧ | Financial Accounting-December-2021-Past-paper |

| ➧ | Financial Accounting-April-2021-Past-paper |

| ➧ | Financial Accounting-August-2021-Past-paper |

CPA past papers with answers