CPA

Intermediate Leval

Economics May 2021 Suggested Solutions

Revision Kit

| ➦ | Economics-September-2015-Pilot-Paper |

| ➦ | Economics-November-2015-Past-Paper |

| ➦ | Economics-May-2016-Past-paper |

| ➦ | Economics-November-2016-Past-Paper |

| ➦ | Economics-November-2017-Past-paper |

| ➦ | Economics-May-2017-Past-paper |

| ➦ | Economics-November-2018-Past-paper |

| ➦ | Economics-May-2018-Past-paper |

| ➦ | Economics-May-2019-Past-paper |

| ➦ | Economics-November-2019-Past-paper |

| ➦ | Economics-November-2020-Past-paper |

| ➦ | Economics-December-2021-Past-paper |

| ➦ | Economics-May-2021-Past-paper |

| ➦ | Economics-August-2021-Past-paper |

QUESTION 1a

The government, through its central bank, can influence the allocation of resources by adjusting interest rates. Changes in interest rates affect borrowing costs and, consequently, investment and consumption patterns.

Government regulations and legislation play a crucial role in shaping the business environment. For example, environmental regulations can impact resource allocation by influencing industries to adopt sustainable practices.

Providing subsidies and incentives to specific industries or activities can direct resources towards desired outcomes. This approach is often used to promote innovation, research, and development.

The government can directly allocate resources through public investment projects. Infrastructure development, education, and healthcare initiatives are examples of areas where public funds can shape resource allocation.

Government trade policies, such as tariffs and

QUESTION 1b

Where:

Point elasticity measures the responsiveness of quantity demanded to a change in price at a specific point on the demand curve. The formula for point elasticity (\(E\)) is given by:

Where:

These formulas are essential tools in economics to understand how changes in price affect the quantity demanded and, consequently, the elasticity of demand.

QUESTION 1(c)

While consumer sovereignty is a fundamental concept in market economies, it has its limitations. Some of the key limitations include:

QUESTION 2(a)

QUESTION 2b

QUESTION 2c

QUESTION 3a

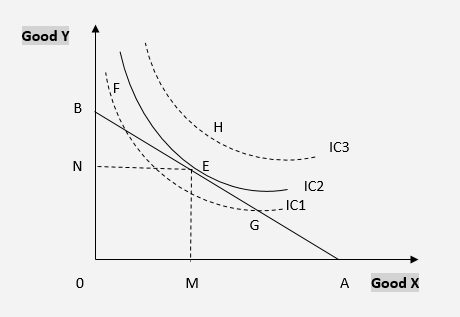

With the budget line as a constraint, the highest attainable indifference curve is IC2. At the point where the budget line is tangent to indifference curve IC2, denoted as 'E', the consumer achieves equilibrium. This implies that the consumer, given the budget constraint, maximizes satisfaction at point 'E' on the indifference curve IC2.

At this equilibrium point 'E', the consumer opts to purchase a quantity of 'X' represented by OM and a quantity of 'Y' represented by ON. It's crucial to note that any other point on the budget line, whether to the left or right of point 'E', corresponds to lower indifference curves, indicating a lower level of satisfaction for the consumer.

The concept of tangency between the budget line and an indifference curve is fundamental. As the budget line can be tangent to only one indifference curve, the consumer optimizes satisfaction at the equilibrium point 'E', meeting both conditions for consumer equilibrium.

QUESTION 3b

QUESTION 3c

QUESTION 4a

QUESTION 4b

Monetary policy aims to achieve the following key objectives in an economy:

QUESTION 4(c)

QUESTION 5a

QUESTION 5b

QUESTION 6a

QUESTION 6b

QUESTION 6(c)

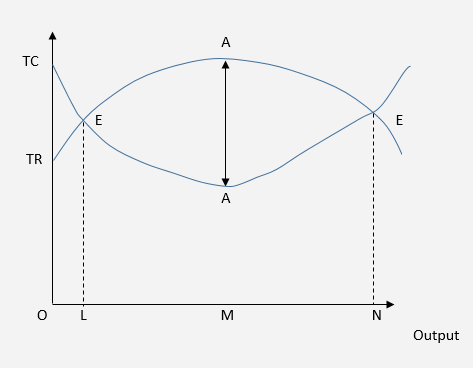

At this point, there is no incentive for further expansion, as any deviation from this size, either larger or smaller, results in decreased efficiency. The firm's cost of production is illustrated to be at its minimum at this optimal point.

In the diagram below, OL represents a situation where total cost exceeds total revenue, indicating a loss for the firm. Point EL signifies the break-even point (BEP), where total revenue equals total cost, resulting in neither profit nor loss. The same applies to point EN.

The maximum profit occurs where the vertical distance between total revenue and total cost is greatest. In the figure, point M represents the maximum profit, where AA is the largest vertical distance.

QUESTION 7(a)

QUESTION 7b

(Note: This is a simplified representation)

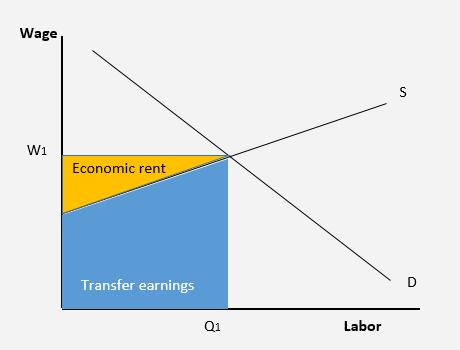

Economic rent refers to the surplus income earned by a factor of production (e.g., land, labor, or capital) that exceeds the minimum amount required to keep it in its current use. It is the payment for a resource above its opportunity cost.

Using economic rent as a basis for taxation: Economic rent represents income earned without the need for additional effort or cost. Taxing economic rent is considered efficient as it does not discourage productive activities or create distortions in the allocation of resources. It can be implemented through measures such as land value taxation, where the tax is levied on the unimproved value of land.

Land, being a fixed and inelastic factor, often generates economic rent. Taxing this rent can have several advantages:

QUESTION 7(c)

| ➧ | Financial Accounting -September-2015-Pilot-Paper |

| ➧ | Financial Accounting -November-2015-Past-Paper |

| ➧ | Financial Accounting -May-2016-Past-paper |

| ➧ | Financial Accounting-November-2016-Past-Paper |

| ➧ | Financial Accounting-November-2017-Past-paper |

| ➧ | Financial Accounting-May-2017-Past-paper |

| ➧ | Financial Accounting-November-2018-Past-paper |

| ➧ | Financial Accounting-May-2018-Past-paper |

| ➧ | Financial Accounting-May-2019-Past-paper |

| ➧ | Financial Accounting-November-2019-Past-paper |

| ➧ | Financial Accounting-November-2020-Past-paper |

| ➧ | Financial Accounting-December-2021-Past-paper |

| ➧ | Financial Accounting-April-2021-Past-paper |

| ➧ | Financial Accounting-August-2021-Past-paper |

| ➧ | Quantitative Analysis -September-2015-Pilot-Paper |

| ➧ | Quantitative Analysis-November-2015-Past-Paper |

| ➧ | Quantitative Analysis-May-2016-Past-paper |

| ➧ | Quantitative Analysis-November-2016-Past-Paper |

| ➧ | Quantitative Analysis-December-2017-Past-paper |

| ➧ | Quantitative Analysis-May-2017-Past-paper |

| ➧ | Quantitative Analysis-November-2018-Past-paper |

| ➧ | Quantitative Analysis-May-2018-Past-paper |

| ➧ | Quantitative Analysis-May-2019-Past-paper |

| ➧ | Quantitative Analysis-November-2019-Past-paper |

| ➧ | Quantitative Analysis-November-2020-Past-paper |

| ➧ | Quantitative Analysis-December-2021-Past-paper |

| ➧ | Quantitative Analysis-April-2021-Past-paper |

| ➧ | Quantitative Analysis-August-2021-Past-paper |

| ➧ | Introduction to Law and Governance-September-2015-Pilot-Paper |

| ➧ | Introduction to Law and Governance-November-2015-Past-Paper |

| ➧ | Introduction to Law and Governance-May-2016-Past-paper |

| ➧ | Introduction to Law and Governance-November-2016-Past-Paper |

| ➧ | Introduction to Law and Governance-May-2017-Past-paper |

| ➧ | Introduction to Law and Governance-November-2017-Past-Paper |

| ➧ | Introduction to Law and Governance-November-2018-Past-paper |

| ➧ | Introduction to Law and Governance-May-2018-Past-paper |

| ➧ | Introduction to Law and Governance-May-2019-Past-paper |

| ➧ | Introduction to Law and Governance-November-2019-Past-paper |

| ➧ | Introduction to Law and Governance-November-2020-Past-paper |

| ➧ | Introduction to Law and Governance-December-2021-Past-paper |

| ➧ | Introduction to Law and Governance-April-2021-Past-paper |

| ➧ | Introduction to Law and Governance-August-2021-Past-paper |

| ➧ | Financial Accounting -September-2015-Pilot-Paper |

| ➧ | Financial Accounting -November-2015-Past-Paper |

| ➧ | Financial Accounting -May-2016-Past-paper |

| ➧ | Financial Accounting-November-2016-Past-Paper |

| ➧ | Financial Accounting-November-2017-Past-paper |

| ➧ | Financial Accounting-May-2017-Past-paper |

| ➧ | Financial Accounting-November-2018-Past-paper |

| ➧ | Financial Accounting-May-2018-Past-paper |

| ➧ | Financial Accounting-May-2019-Past-paper |

| ➧ | Financial Accounting-November-2019-Past-paper |

| ➧ | Financial Accounting-November-2020-Past-paper |

| ➧ | Financial Accounting-December-2021-Past-paper |

| ➧ | Financial Accounting-April-2021-Past-paper |

| ➧ | Financial Accounting-August-2021-Past-paper |

CPA past papers with answers